Published on December 27th, 2024 by Bob Ciura

Spreadsheet data updated daily

Conservative retirement investing is all about creating passive income with quality securities, held for the long-run.

At Sure Dividend, we focus on dividend paying stocks (and closely related REITs, MLPs, and BDCs) to build a growing and reliable passive income stream.

When it comes to reliable dividend payers, there are no better stocks than the Dividend Kings.

The Dividend Kings are the best-of-the-best in dividend longevity.

What is a Dividend King? A stock with 50 or more consecutive years of dividend increases.

You can see the full downloadable spreadsheet of all 54 Dividend Kings (along with important financial metrics such as dividend yields, payout ratios, and price-to-earnings ratios) by clicking on the link below:

Conservative retirement income investing prioritizes dividend longevity, and dividend safety.

The highest concentration of the Dividend Kings list come from the Consumer Staples, Industrials, and Utilities sectors. These are the best market sectors for investors looking for conservative retirement income.

This article will list the 10 highest-yielding Dividend Kings, from the Consumer Staples, Industrials, and Utilities sectors.

The 10 conservative retirement income stocks below have Dividend Risk Scores of A or B, indicating strong dividend safety.

The 10 stocks are ranked by dividend yield, from lowest to highest.

The stocks are ranked by dividend yield, from lowest to highest.

Table of Contents

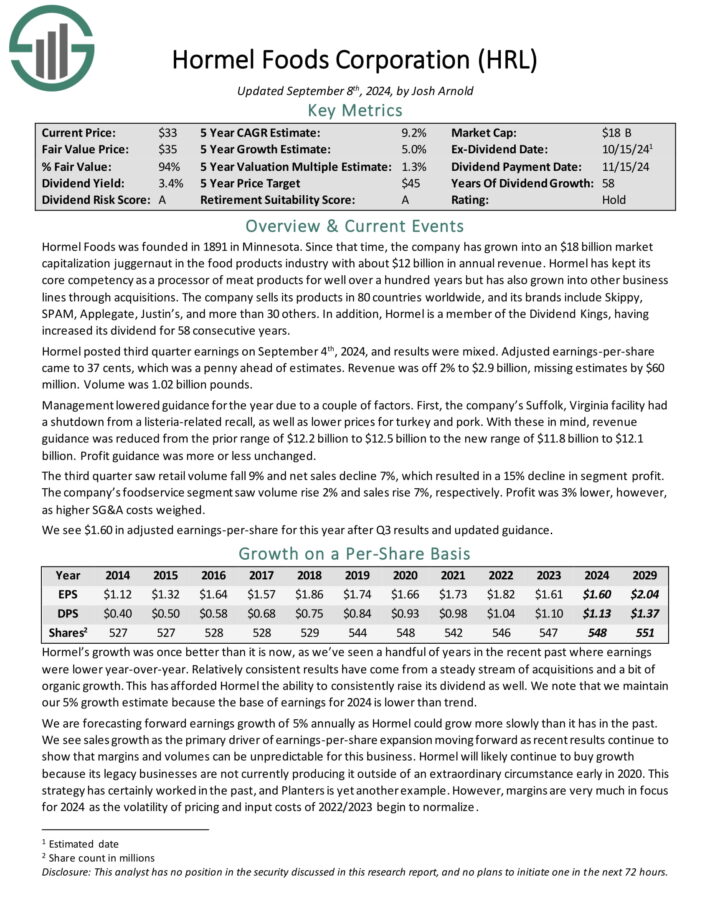

Conservative Retirement Income Stock: Hormel Foods (HRL)

Hormel Foods is a juggernaut in the food products industry with nearly $10 billion in annual revenue. It has a large portfolio of category-leading brands. Just a few of its top brands include include Skippy, SPAM, Applegate, Justin’s, and more than 30 others.

It has also pursued acquisitions to drive growth. For example, in 2021, Hormel acquired the Planters snack nuts business from Kraft-Heinz (KHC) for $3.35 billion, which has boosted Hormel’s growth.

Source: Investor Presentation

Hormel Foods Corporation reported strong Q3 fiscal 2024 results, with net sales of $2.9 billion and adjusted operating income of $267 million, exceeding expectations.

Key drivers included strong performances in retail brands and international markets, supported by ongoing improvements from the company’s modernization initiatives.

The company posted diluted earnings per share of $0.32 ($0.37 adjusted) and a cash flow from operations of $218 million.

Click here to download our most recent Sure Analysis report on Hormel (preview of page 1 of 3 shown below):

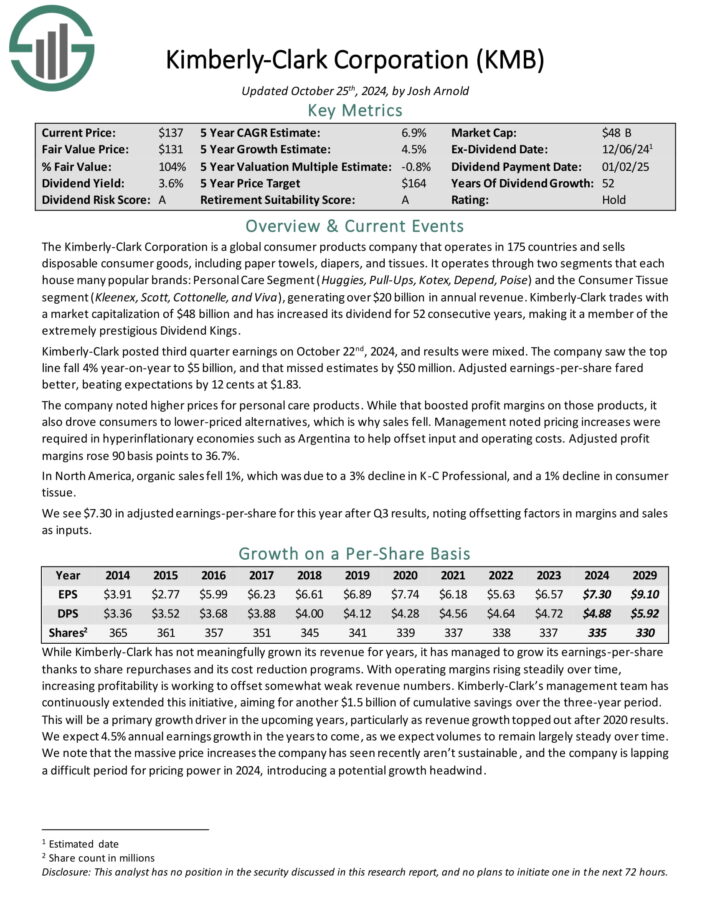

Conservative Retirement Income Stock: Kimberly-Clark (KMB)

Kimberly-Clark is a global consumer products company that operates in 175 countries and sells disposable consumer goods, including paper towels, diapers, and tissues.

It operates segments that each house many popular brands: the Personal Care Segment (Huggies, Pull-Ups, Kotex, Depend, Poise), the Consumer Tissue segment (Kleenex, Scott, Cottonelle, and Viva), and a professional segment. In all, KMB generates ~$21 billion in annual revenue.

Source: Investor Presentation

Kimberly-Clark posted third quarter earnings on October 22nd, 2024, and results were mixed. The company saw the top line fall 4% year-on-year to $5 billion, and that missed estimates by $50 million. Adjusted earnings-per-share fared better, beating expectations by 12 cents at $1.83.

The company noted higher prices for personal care products. While that boosted profit margins on those products, it also drove consumers to lower-priced alternatives, which is why sales fell.

Management noted pricing increases were required in hyper-inflationary economies such as Argentina to help offset input and operating costs. Adjusted profit margins rose 90 basis points to 36.7%.

Click here to download our most recent Sure Analysis report on Kimberly-Clark (preview of page 1 of 3 shown below):

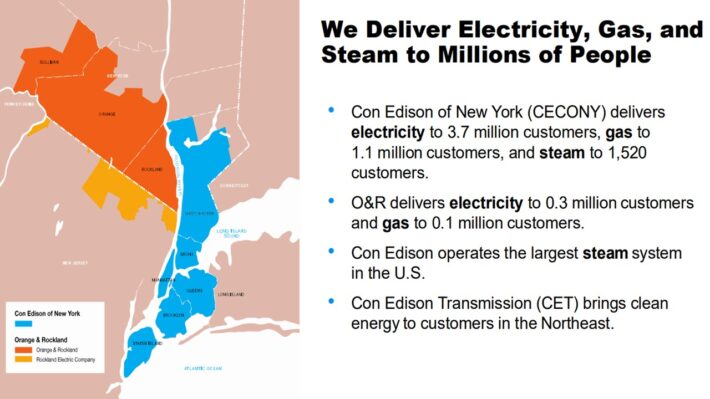

Conservative Retirement Income Stock: Consolidated Edison (ED)

Consolidated Edison is a large-cap utility stock. The company generates nearly $15 billion in annual revenue and has a market capitalization of approximately $36 billion.

The company serves 3.7 million electric customers, and another 1.1 million gas customers, in New York.

Source: Investor Presentation

It operates electric, gas, and steam transmission businesses, with a steam system that is the largest in the U.S.

On November 7th, 2024, Consolidated Edison reported third quarter results. For the quarter, revenue improved 5.7% to $4.1 billion, which topped estimates by $26 million.

Adjusted earnings of $583 million, or $1.68 per share, compared to adjusted earnings of $561 million, or $1.62 per share, in the previous year. Adjusted earnings-per-share were $0.10 more than anticipated.

As with prior periods, higher rate bases for gas and electric customers were the primary contributors to results in the CECONY business, which accounts for the vast majority of the company’s assets.

Average rate base balances are still expected to grow by 6.4% annually for the 2024 to 2028 period.

Click here to download our most recent Sure Analysis report on Consolidated Edison (preview of page 1 of 3 shown below):

Conservative Retirement Income Stock: Kenvue Inc. (KVUE)

Kenvue is a consumer staples company with three segments: Self Care, Skin Health and Beauty, and Essential Health. Self Care’s product portfolio includes cough, cold, allergy, smoking cessation, and pain care products among others.

Skin Health and Beauty holds products such as face, body, hair, and sun care. Essential Health contains products for women’s health, wound care, oral care, and baby care.

Well-known brands in Kenvue’s product line up include Tylenol, Listerine, Band-Aid, Neutrogena, Nicorette, and Zyrtec. These businesses contributed approximately 17% of Johnson & Johnson’s annual revenue.

On November 7th, 2024, Kenvue reported third quarter earnings results for the period ending September 30th, 2024. Revenue decreased 0.5% to $3.9 billion, which was $20 million less than expected.

Adjusted earnings-per-share of $0.28 compared unfavorably to $0.31 last year, but this was $0.01 above estimates.

Organic sales were up 0.9% for the quarter, which follows a 3.6% improvement last year. For the quarter, pricing and mix benefit of 2.5% was offset by a 1.6% decline in volume.

Once again, volume growth in Essential Health was offset by weakness in Skin Health and Beauty and Self Care. Gross profit margin expanded 100 basis points to 58.5%.

Click here to download our most recent Sure Analysis report on KVUE (preview of page 1 of 3 shown below):

Conservative Retirement Income Stock: Archer Daniels Midland (ADM)

Archer-Daniels-Midland is the largest publicly traded farmland product company in the United States. Archer-Daniels-Midland’s businesses include processing cereal grains, oilseeds, and agricultural storage and transportation.

Archer-Daniels-Midland reported its third-quarter results for Fiscal Year (FY) 2024 on November 18th, 2024. The company reported adjusted net earnings of $530 million and adjusted EPS of $1.09, both down from the prior year due to a $461 million non-cash charge related to its Wilmar equity investment.

Consolidated cash flows year-to-date reached $2.34 billion, reflecting strong operations despite market challenges.

Click here to download our most recent Sure Analysis report on ADM (preview of page 1 of 3 shown below):

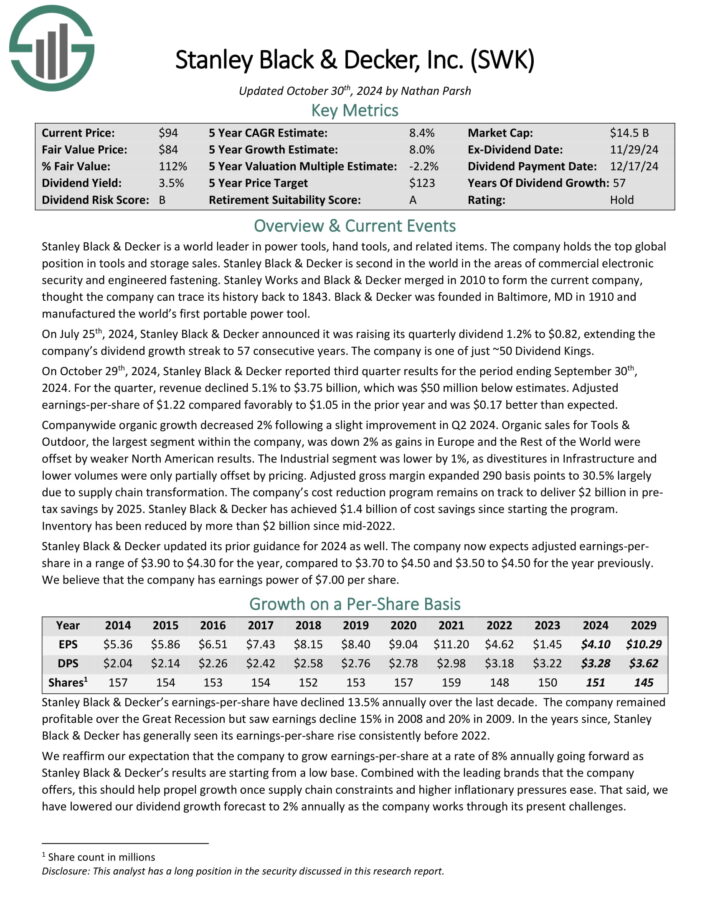

Conservative Retirement Income Stock: Stanley Black & Decker (SWK)

Stanley Black & Decker is a world leader in power tools, hand tools, and related items. The company holds the top global position in tools and storage sales.

It is second in the world in the areas of commercial electronic security and engineered fastening. The company is composed of three segments: tools & outdoor, and industrial.

Source: Investor Presentation

On October 29th, 2024, Stanley Black & Decker reported third quarter results. For the quarter, revenue declined 5.1% to $3.75 billion, which was $50 million below estimates. Adjusted earnings-per-share of $1.22 compared favorably to $1.05 in the prior year and was $0.17 better than expected.

Company-wide organic growth decreased 2% following a slight improvement in Q2 2024. Organic sales for Tools & Outdoor, the largest segment within the company, was down 2% as gains in Europe and the Rest of the World were offset by weaker North American results.

Click here to download our most recent Sure Analysis report on SWK (preview of page 1 of 3 shown below):

Conservative Retirement Income Stock: Black Hills Corp. (BKH)

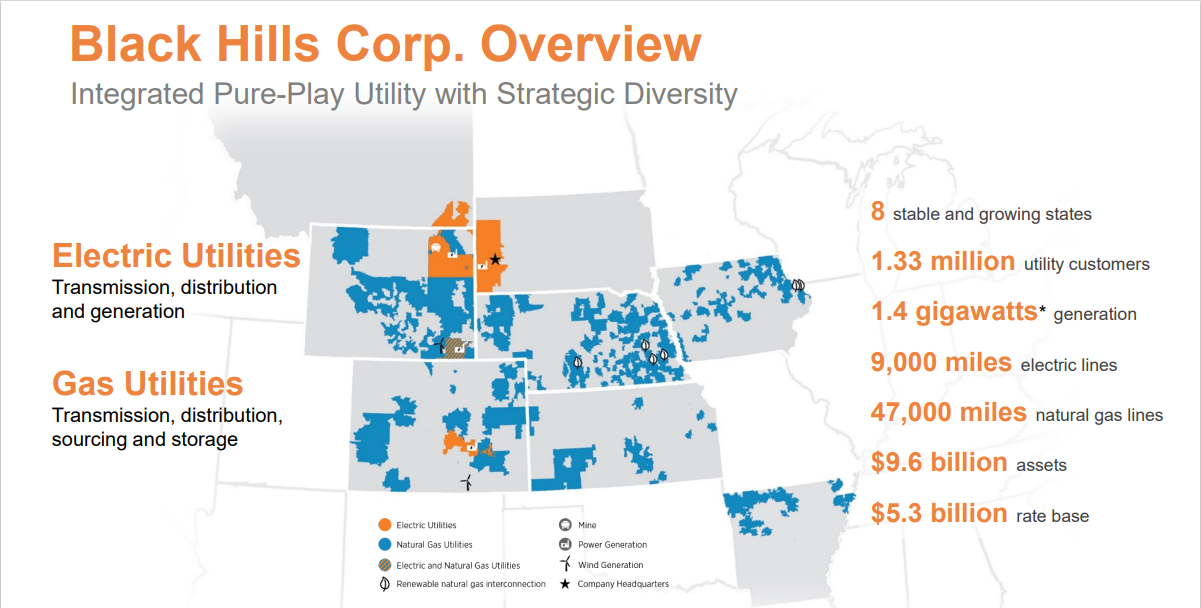

Black Hills Corporation is an electric utility that provides electricity and natural gas to customers in Colorado, Iowa, Kansas, Montana, Nebraska, South Dakota, and Wyoming.

The company has 1.33 million utility customers in eight states. Its natural gas assets include 47,000 miles of natural gas lines. Separately, it has ~9,000 miles of electric lines and 1.4 gigawatts of electric generation capacity.

Source: Investor Presentation

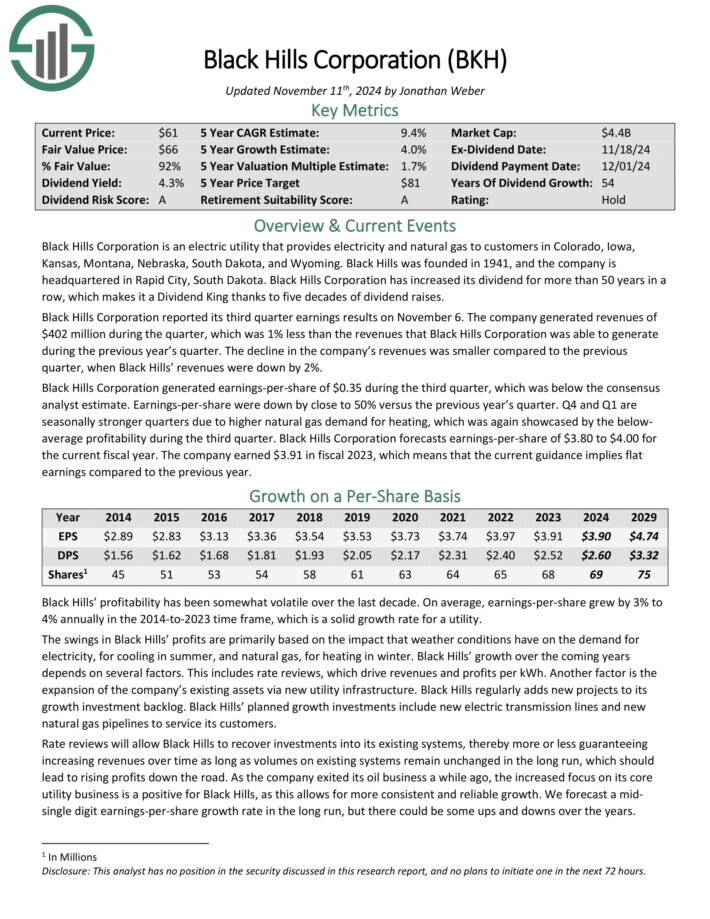

Black Hills Corporation reported its third quarter earnings results on November 6. The company generated revenues of $402 million during the quarter, down 1% year-over-year.

Black Hills Corporation generated earnings-per-share of $0.35 during the third quarter, which was below the consensus analyst estimate. Earnings-per-share were down by close to 50% versus the previous year’s quarter.

Click here to download our most recent Sure Analysis report on BKH (preview of page 1 of 3 shown below):

Conservative Retirement Income Stock: Northwest Natural Holding (NWN)

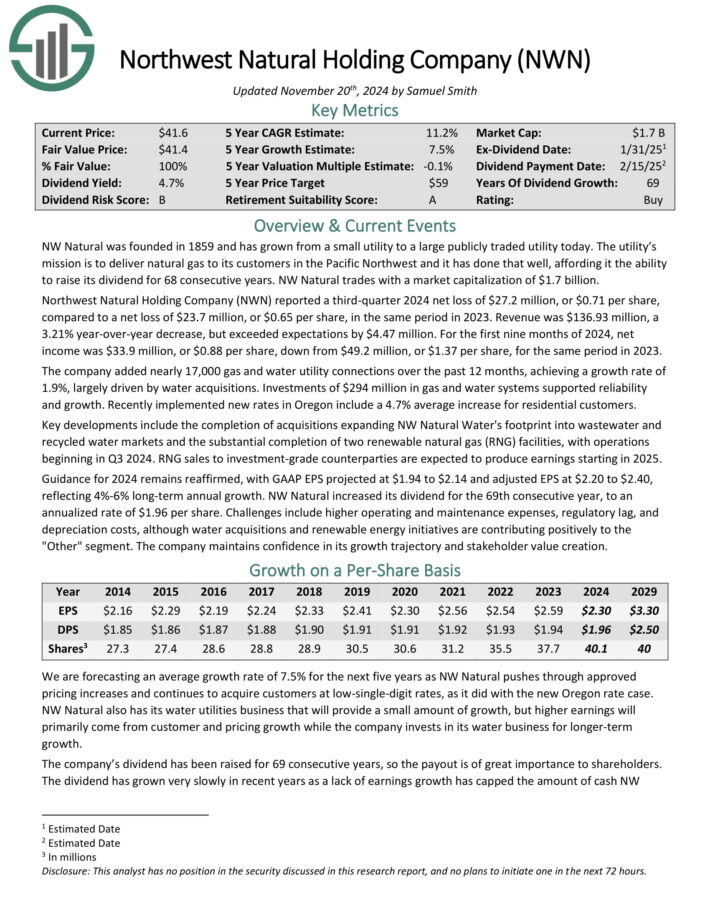

Northwest Natural was founded over 160 years ago as a natural gas utility in Portland, Oregon.

It has grown from a very small, local utility that provided gas service to a handful of customers to a regional utility with interests that now include water and wastewater, which were purchased in recent acquisitions.

The company’s locations served are shown in the image below.

Source: Investor Presentation

Northwest provides gas service to 2.5 million customers in ~140 communities in Oregon and Washington, serving more than 795,000 connections. It also owns and operates ~35 billion cubic feet of underground gas storage capacity.

Northwest Natural Holding Company reported a third-quarter 2024 net loss of $27.2 million, or $0.71 per share, compared to a net loss of $23.7 million, or $0.65 per share, in the same period in 2023. Revenue was $136.93 million, a 3.21% year-over-year decrease, but exceeded expectations by $4.47 million.

For the first nine months of 2024, net income was $33.9 million, or $0.88 per share, down from $49.2 million, or $1.37 per share, for the same period in 2023.

Click here to download our most recent Sure Analysis report on NWN (preview of page 1 of 3 shown below):

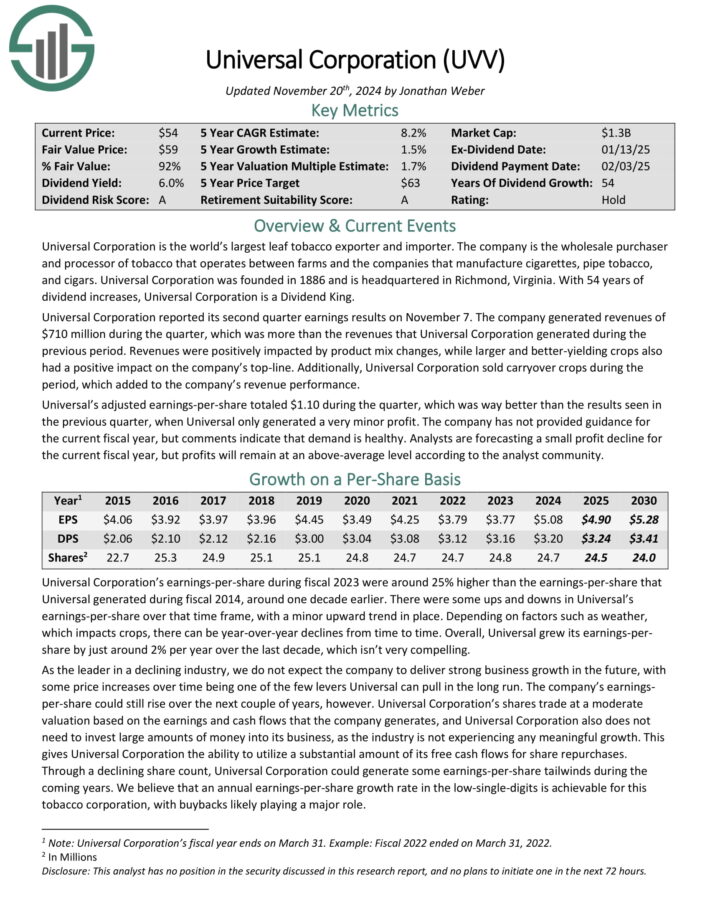

Conservative Retirement Income Stock: Universal Corporation (UVV)

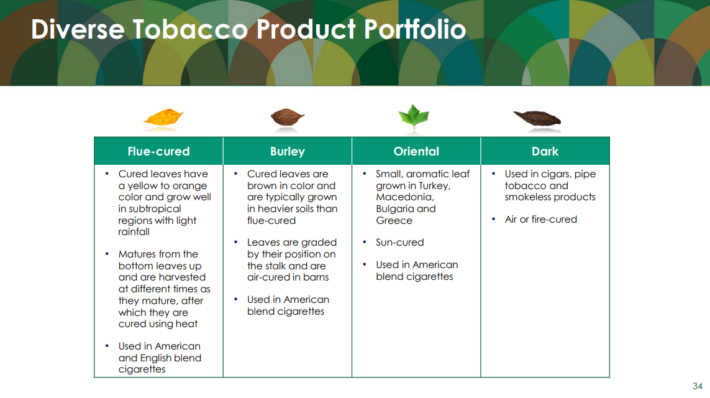

Universal Corporation is a market leader in supplying leaf tobacco and other plant-based inputs to consumer product manufacturers.

The Tobacco Operations segment buys and sells tobacco used to make cigarettes, cigars, pipe tobacco, and smokeless products.

Universal buys tobacco from its suppliers, processes it, and sells it to large tobacco companies in the US and internationally.

Source: Investor Presentation

The Ingredient Operations deal mainly with vegetables and fruits but is significantly smaller than the tobacco operations. Universal has been growing this business through acquisitions starting in 2020.

Universal Corporation reported its second quarter earnings results on November 7. The company generated revenues of $710 million during the quarter.

Additionally, Universal Corporation sold carryover crops during the period, which added to the company’s revenue performance.

Click here to download our most recent Sure Analysis report on Universal (preview of page 1 of 3 shown below):

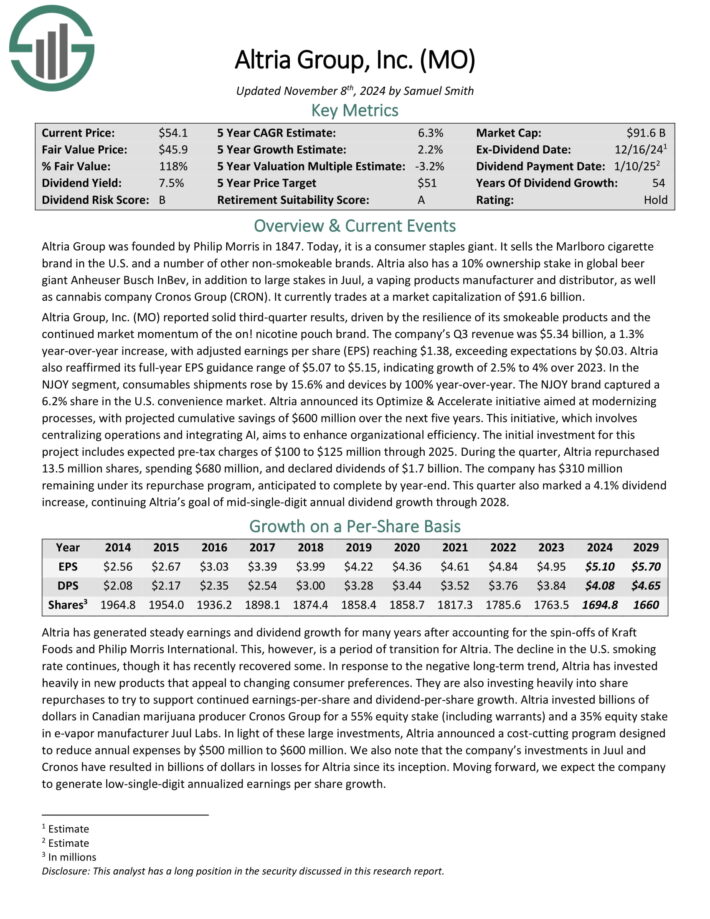

Conservative Retirement Income Stock: Altria Group (MO)

Altria is a tobacco stock that sells cigarettes, chewing tobacco, cigars, e-cigarettes, and more under a variety of brands, including Marlboro, Skoal, and Copenhagen, among others.

The company also has a 35% investment stake in e-cigarette maker JUUL, and a 45% stake in the cannabis company Cronos Group (CRON).

Altria reported solid third-quarter results, driven by the resilience of its smokeable products and the continued market momentum of the on! nicotine pouch brand.

Source: Investor Presentation

The company’s Q3 revenue was $5.34 billion, a 1.3% year-over-year increase, with adjusted earnings per share (EPS) reaching $1.38, exceeding expectations by $0.03.

Altria also reaffirmed its full-year EPS guidance range of $5.07 to $5.15, indicating growth of 2.5% to 4% over 2023.

During the quarter, Altria repurchased 13.5 million shares, spending $680 million, and declared dividends of $1.7 billion. The company has $310 million remaining under its repurchase program, anticipated to complete by year-end.

Click here to download our most recent Sure Analysis report on Altria (preview of page 1 of 3 shown below):

Final Thoughts

Screening to find the best Dividend Kings is not the only way to find high-quality dividend growth stock ideas.

Sure Dividend maintains similar databases on the following useful universes of stocks:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].