As global markets navigate a mixed start to the year, with indices showing varied performances and economic indicators like the Chicago PMI highlighting ongoing challenges, investors are increasingly turning their focus to stable income-generating options. In this context, dividend stocks become particularly appealing as they offer the potential for regular income streams amidst market fluctuations.

|

Name |

Dividend Yield |

Dividend Rating |

|

Tsubakimoto Chain (TSE:6371) |

4.35% |

★★★★★★ |

|

Wuliangye YibinLtd (SZSE:000858) |

3.63% |

★★★★★★ |

|

CAC Holdings (TSE:4725) |

4.73% |

★★★★★★ |

|

Yamato Kogyo (TSE:5444) |

4.06% |

★★★★★★ |

|

Padma Oil (DSE:PADMAOIL) |

7.49% |

★★★★★★ |

|

GakkyushaLtd (TSE:9769) |

4.39% |

★★★★★★ |

|

China South Publishing & Media Group (SHSE:601098) |

4.09% |

★★★★★★ |

|

Nihon Parkerizing (TSE:4095) |

4.00% |

★★★★★★ |

|

FALCO HOLDINGS (TSE:4671) |

6.64% |

★★★★★★ |

|

DoshishaLtd (TSE:7483) |

3.81% |

★★★★★★ |

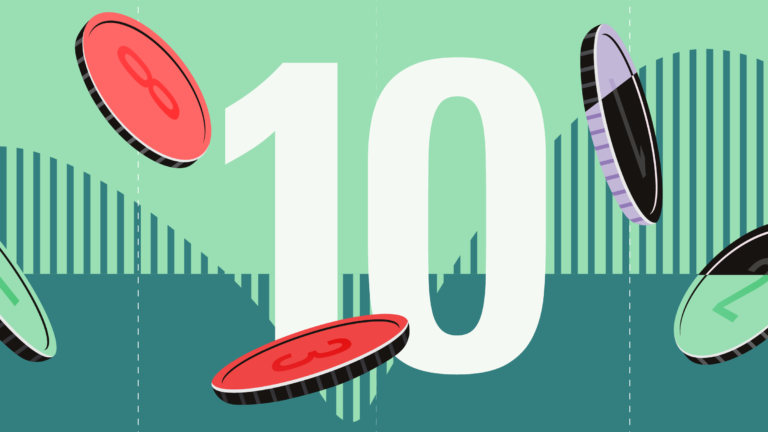

Click here to see the full list of 2010 stocks from our Top Dividend Stocks screener.

Let’s explore several standout options from the results in the screener.

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Dong-E-E-Jiao Co., Ltd. engages in the research, development, production, and sale of Ejiao along with various Chinese patent medicines and health foods, with a market cap of CN¥39.67 billion.

Operations: Dong-E-E-Jiao Co., Ltd. generates revenue primarily from the operation of Ejiao and its series of products, amounting to CN¥5.62 billion.

Dividend Yield: 3.7%

Dong-E-E-Jiao Ltd. has shown robust earnings growth, with a 44.6% increase over the past year and recent nine-month net income rising to CNY 1.15 billion from CNY 783.67 million a year ago, indicating strong financial performance. However, its dividend payments have been volatile over the past decade and are not well covered by earnings due to a high payout ratio of 123.8%. Despite this, it offers a competitive yield of 3.7%, ranking in the top quartile in China, though sustainability concerns persist given its cash flow coverage challenges and historical volatility in dividends.

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Newland Digital Technology Co., Ltd. offers bar code and financial POS terminal equipment, mobile and communications services, as well as IoT solutions both in China and internationally, with a market cap of CN¥18.55 billion.

Operations: Newland Digital Technology Co., Ltd. generates revenue through its offerings in bar code and financial POS terminal equipment, mobile communication services, and IoT solutions across domestic and international markets.